sales tax calculator memphis tn

The Shelby County sales tax rate is. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

![]()

City Of Memphis Epayments Site

Jackson Hewitt Tax Service.

. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis. For vehicles that are being rented or leased see see taxation of leases and rentals. Real property tax on median home.

Sales taxes will be calculated as follows. The local tax rate may not be higher than 275 and must be a multiple of 25. The Tennessee state sales tax rate is currently.

All local jurisdictions in Tennessee have a local sales and use tax rate. To calculate the amount of your taxes multiply the assessed value of your property times the tax rate divided by 100. State Tax - 7 of the entire purchase price Note.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax Calculator in Memphis TN. The Tennessee sales tax rate is currently.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN. Name A - Z Sponsored Links. Name A - Z Sponsored Links.

The current total local sales tax rate in Memphis TN is 9750. WarranteeService Contract Purchase Price. For example lets say that you want to purchase a new car for 60000 you.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN. The December 2020 total local sales tax rate was also 9750. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN.

This is the total of state county and city sales tax rates. Sales Tax Calculator in Memphis TN. The sales tax is comprised of two parts a state portion and a local.

If a vehicle is purchased in another state the owner must pay the difference in the tax rate and the. The 2018 United States Supreme Court. Vehicle Sales Tax Calculator.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07. Tennessee has a 7 statewide sales tax rate but.

Tennessee collects a 7 state sales tax rate. The local sales tax rate and use. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN.

There is a maximum tax charge of 36 dollars for county. This is the total of state and county sales tax rates. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN.

Sales Tax State Local Sales Tax on Food. Memphis collects the maximum legal local sales tax.

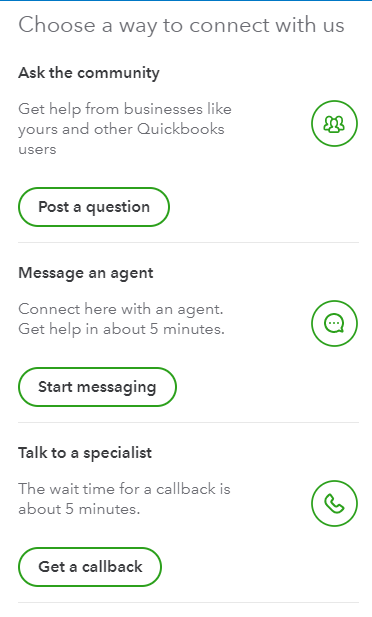

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tennessee Sales Tax Small Business Guide Truic

How To Calculate California Sales Tax 11 Steps With Pictures

Ford Edge For Sale Memphis Tn Autonation Ford Wolfchase

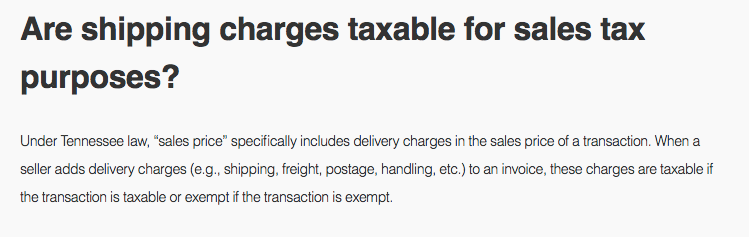

Is Shipping In Tennessee Taxable Taxjar

Tax Comparison Florida Verses Tennessee

Sales Tax Calculator And Rate Lookup 2021 Wise

Tennessee Sales Use Tax Guide Avalara

Tax Free Exchange Package Tennessee Fill Out Sign Online Dochub

How High Are Spirits Taxes In Your State Tax Foundation

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Missouri Sales Tax Rates By City County 2022

How Capital Gains Work When Selling A House In Tennessee

Report Tennessee Has Second Lowest Overall Tax Burden The Courier