how to get uber eats tax summary

As an Uber driver-partner you can also sign up for its food delivery service Uber Eats and earn more money. Uber notes that the service fee only applies to orders delivered by Uber Eats drivers from local restaurants.

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Your annual Tax Summary should be available on July 7.

. If youre classified as a courier youre in luck. This is simply not true. My situation is the current one.

Uber Eats fulfills the sentiments of the consumers regarding their culture and lifestyle. The Uber Eats has positioned in the mind of the customers. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and.

You also know the things that you can control to increase your earnings. Music services like Spotify or Apple. The Uber Eats pay model boils down to four things.

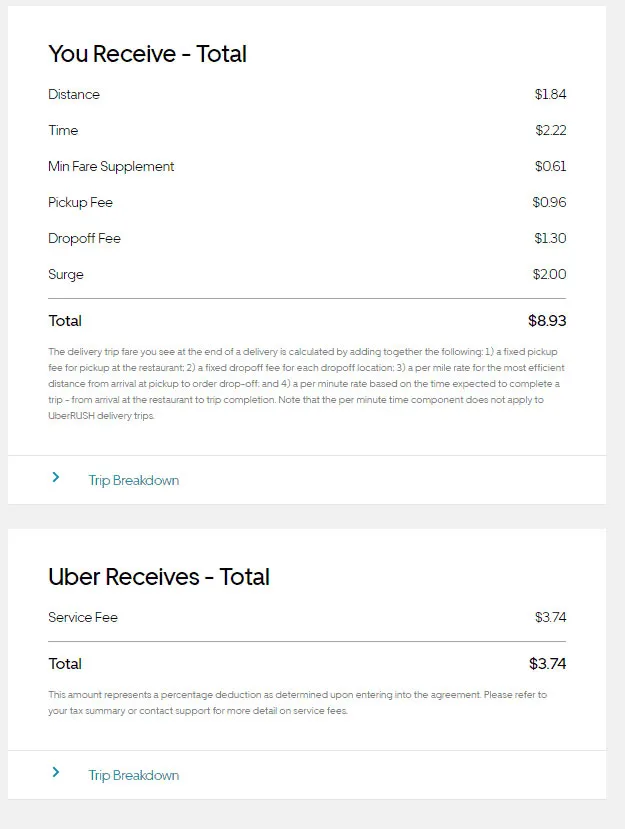

You receive these amounts from your rider as income and then you pass them on to Uber as an expense. As you can see they cancel each other out meaning you pay 0 GST on these amounts. Dont think in terms of paychecks from Doordash Instacart Grubhub Uber Eats Lyft but think in terms of Profit and Loss.

Trunk organizers or delivery bags for Uber Eats. Uber Eats has increased its supply chain and provides food at the doorstep of the consumer so. The consumers need not be present physically at the outlet of the Uber Eats to get food.

Click on Tax Summary Select the relevant statement. All income items on your Uber tax summary must be declared to the ATO because they are money you receive from the passenger split fare fees tolls city fees booking fees etc and therefore legally they are taxable income. Plus there may be additional state and local tax forms youll need as wellcheck with your tax service or professional.

Deliver Food with Uber Eats. When you understand how the payments work with Uber Eats you get a better feel for what you can make. The Uber Eats service fee is a consumer fee that appears on the price breakdown at checkout in the app.

This is reflected within the Uber Partner app and in a summary at the end of the year. This leads some to believe you can only deduct miles where a passenger is paying you. If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will separately determine if you meet the earnings and trip criteria to receive a 1099-K 1099-NEC andor a 1099-MISC.

I know the tax. Uber only provides a report of the miles for which you have a paying passenger pax in your car. The biggest names in food delivery apps in the US.

You can deliver Uber Eats orders by. Are DoorDash Uber Eats Postmates and. Youll report income through the standard tax return Form 1040.

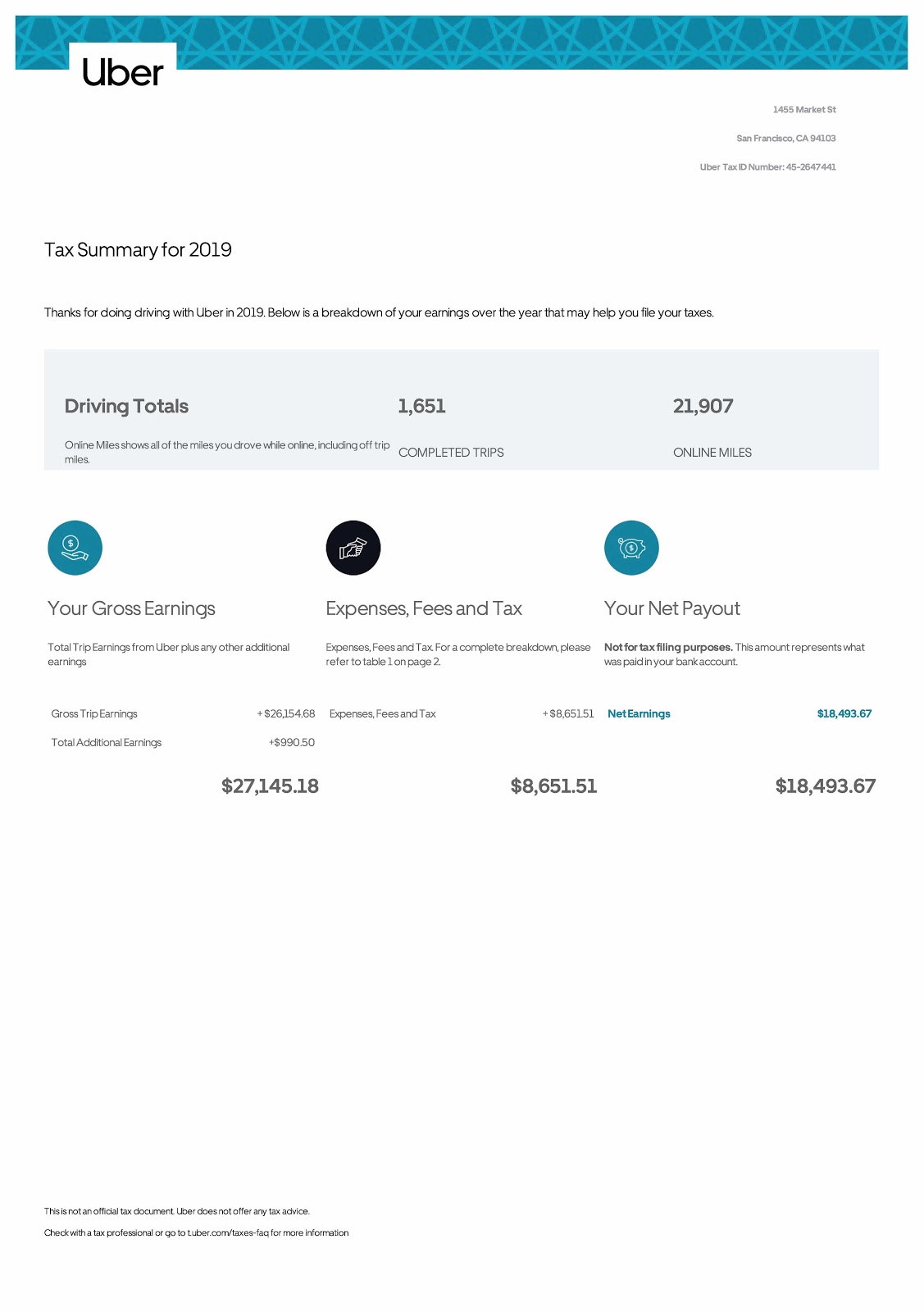

You will receive two tax summaries. So heres how the tax calculation works in our example Uber figures above. A full RTL interface In the first blog of our new theme series we featured all the major upgrades and enhancements to Zoho MailIn this blog we are going to delve into the RTL Right-to-left UI orientation in Zoho Mailsuite.

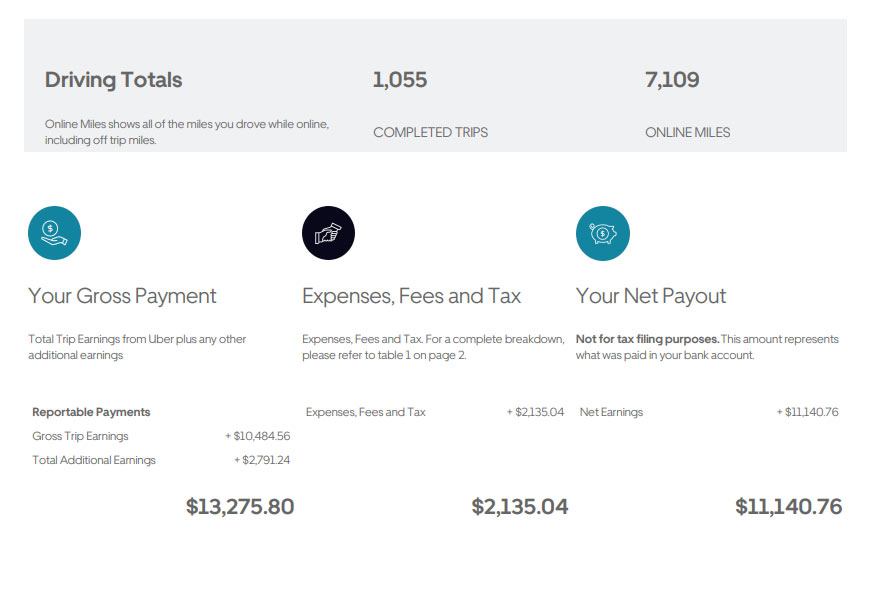

Before diving into the data first lets set the stage. Cell phone accessories and a portion of your cell phone. Heres an example of what this looks like on a monthly Uber Tax Summary.

In most cases your Uber Tax Summary will be available by January 31. Your Tax Summary document includes helpful information. Thats going to get you off on the wrong foot.

With Uber Eats youll be required to accept food delivery gigs pick up orders from restaurants and deliver them to your customers within an hour. Where to find your tax information. You should receive your income information from Uber.

For the FY 2018-2019 I got less than 18200 Uber Eats Employer. Dont have an account. Youll use Schedule C to list your income and expenses and expenses write-offs.

Arabic Style released. What If You Deliver for an Online Food Ordering Company like Uber Eats or SkipTheDishes. Delivery fees their Trip Supplement Incentives and Customer Tips.

You will receive one tax summary for all activity with Uber Eats and Uber. This new structure replaces the former booking fee attached to Uber Eats orders. Do not tell a lender or apartment management company that you are an employee of Doordash Uber Eats Grubhub or any of the gig companies.

The Canada Revenue Agency CRA looks at being a courier for a food delivery app and being a driver for a ride sharing app as two different business activities so the tax reporting requirements differ for each. Sign In Email or mobile number. Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies.

You can find tax information on your Uber profilewell provide you with a monthly and annual Tax Summary.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

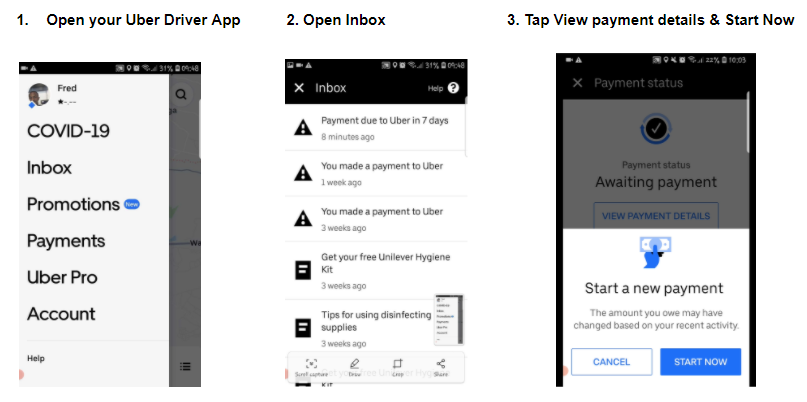

How To Pay Your Service Fee To Uber Using Uber Drivers App Uber Blog

How To Pay Your Service Fee To Uber Using Uber Drivers App Uber Blog

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Documentos Fiscales Para Socios De La App

If You Re A Serious Driver You Can T Go Wrong With Our Piloch Air Vent Phone Holder Uber Promo Code Uber App Coding

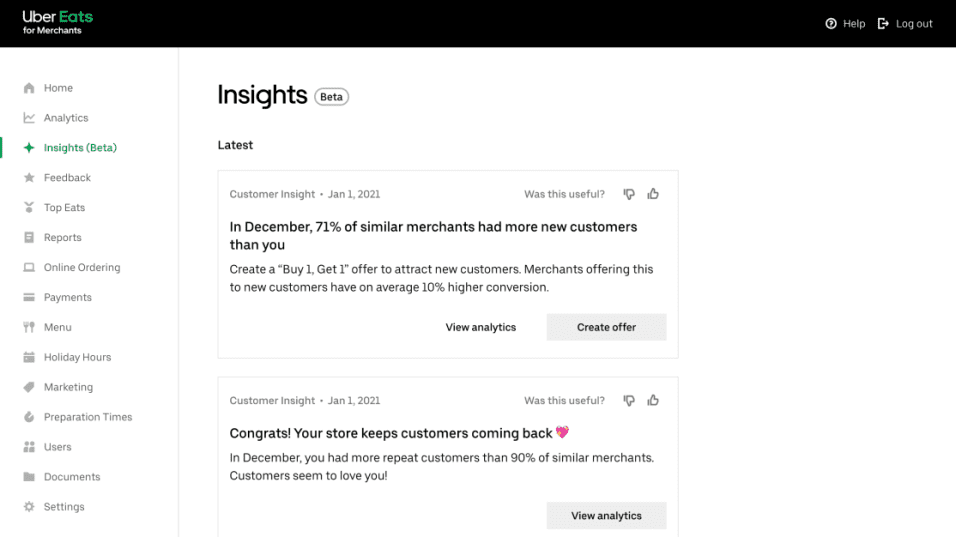

Analytics And Insights On Uber Eats Merchant Academy

Uber Vat Compliance For Dutch Partner Drivers

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Eats Windsor Driver Pay And Requirements For Sign Up Uberx Uber Uber Driver

How To Understand Uber Eats 1099s When They Lie About Your Pay

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Eats Order Summary Explained

Uber Vat Compliance For Spanish Uber Eats Delivery Partners

See This Post By Startup Ca On Google Https Posts Gle Ddif2 Www Startupca Org Decisions Announced Today At Fm Press Start Up Income Tax Return Income Tax

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier